Roo

Capital

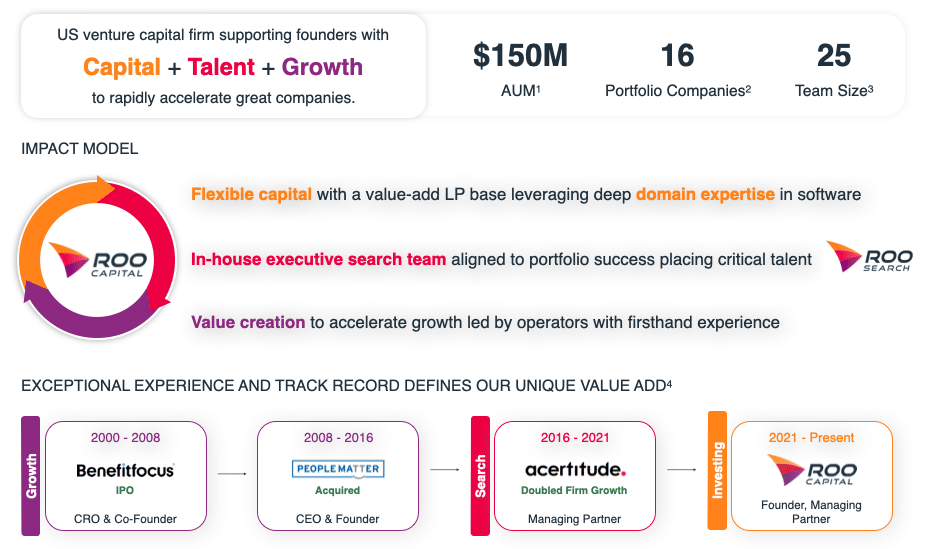

Deploying Smart Capital: Providing Early-Stage Funding and Strategic Financial Structuring to Optimize Runway and Accelerate Flywheel Growth.

Roo Capital

Flexible capital with a value-add LP base leveraging deep domain expertise in software.

Roo Growth

Value creation to accelerate growth led by operators with firsthand experience.

Roo Talent / Search

In-house executive search team aligned to portfolio success placing critical talent.

Roo Capital

Flexible capital with a value-add LP base leveraging deep domain expertise in software.

Roo Growth

Value creation to accelerate growth led by operators with firsthand experience.

Roo Talent / Search

In-house executive search team aligned to portfolio success placing critical talent.

Foundational Investment in Targeted Sectors

The Capital pillar is the foundation of Roo Capital’s Impact Model, designed to provide flexible and agile funding tailored to the needs of early-stage, category-defining software companies.

We focus our investments in specific high-growth sectors—Healthcare Tech, SaaS + AI, and Cybersecurity—where our deep domain expertise and operational history provide a distinct advantage in both sourcing and underwriting.

We ensure our capital is deployed at the most critical stages, from Pre-Seed to Series A, where the funds can be maximized to accelerate market penetration and product maturity. We aim for significant ownership by Series A to gain meaningful influence in supporting breakthrough outcomes.

Strategic Sourcing and Structuring

In addition to the initial check, we leverage our network to provide strategic financial structuring and access to co-investment opportunities.

Our ability to source high-quality deal flow is a core differentiator, utilizing our proprietary network of A-Listers (executive advisors) and institutional partners to ensure a disciplined, thorough underwriting process.

Our check sizes are tailored to each stage, ensuring the right amount of funding is provided to match the company’s needs and traction milestones.

Operationalizing Financial Rigor

The strategic deployment of capital is further amplified by the operational expertise of the Roo team, effectively linking investment decisions to growth execution.

This means using financial insights not just for compliance, but for strategy—advising on value-based pricing, optimizing cost centers to measure ROI, and implementing cohort analysis to properly track LTV and retention.

This operational rigor ensures that capital is deployed efficiently and sustainably, focusing on unit economics vigilance rather than just “blitz-scale” growth.

Roo Capital: A Lever for Sustainable Growth

The Roo Capital pillar provides founders with more than liquidity; it offers flexible funding married to strategic financial guidance and a focus on unit economics. By deploying funds alongside a clearly defined path to profitability and a commitment to operational efficiency, Roo Capital turns investment checks into levers for accelerated, sustainable market scaling.

Integrated Capital: The Path to Category Leadership

Ultimately, this foundational pillar ensures that founders have the stability and resources to focus on their vision, while Roo Capital shoulders the rigor of capital deployment and financial structuring. This systematic approach, integrated with the Talent and Growth pillars, allows Roo to systematically support great companies from their earliest formation, positioning them for premium multiples and successful later-stage rounds or strategic exits.